Streamlining sustainability reporting: why the issue isn’t length, but integration

Synopsis

• Finance and sustainability teams face pressure to reduce report length and align sustainability disclosures with core reporting.

• The challenge is not just volume, but sustainability being treated as a parallel narrative, owned by specialist teams and misaligned with strategy, governance and risk.

• This drives duplication and report bloat, when it should be prompting companies to restructure how sustainability information is presented rather than simply adding content.

The challenge facing finance and sustainability teams

Over the past few years, through my work with IMS Transition and Finance (IMS) and Accounting for Sustainability1 (A4S), I have heard the same concerns repeatedly from boards, finance teams and sustainability leads:

• How can we reduce the page count?

• How can we rationalise sustainability reporting?

• How do we ensure consistency across our external reporting?

Sustainability disclosure is often cited as a key driver of report growth, reflecting the rapid expansion of reporting requirements and evolving best practice. These have been shaped by bodies such as the IFRS Foundation and EFRAG alongside heightened investor scrutiny. However, focusing purely on length risks missing the real issue.

The core challenge is not that sustainability reporting exists, or even that it is extensive. It is that sustainability is still too often treated as a parallel narrative, owned by separate teams, operating on different time horizons and expressed in different language from core strategy, governance and risk. This structural separation is what creates duplication, misalignment and, ultimately, report bloat. Sustainability should go beyond surface-level actions or greenwashing to reflect a deep integration with an organisation’s culture and strategy.

1 Accounting for Sustainability (A4S) was established by HM King Charles III in 2004, when he was The Prince of Wales, “to help ensure that we are not battling to meet 21st century challenges with, at best, 20th century decision making and reporting systems.”

Why sustainability disclosures so often feel disconnected

Several structural tensions sit behind today’s reporting challenges:

• Mismatched time horizons: Sustainability strategies typically look decades ahead (often to 2050), while corporate strategies and capital allocation decisions are usually framed over 3–5 years.

• Parallel ownership and language: Sustainability reporting is frequently produced by specialist teams, with involvement from other teams resisted, resulting in narratives that do not fully align with the organisation’s central strategy, risk appetite or financial framing.

• Duplicative disclosure requirements: Many sustainability standards require disclosures on governance, strategy and risk management that mirror existing corporate reporting, leading to duplication of information that should already be subject to fair, balanced and comprehensive disclosure within the main annual report.

Under intense time pressure to publish annual reports, these tensions result in disclosures that are overlapping, fragmented and longer than they need to be, even before considering standalone sustainability reports, transition plans and other supplementary submissions such as CDP.

How companies are responding in practice

With growing pressure to report on climate, nature, workforce and social value, one might expect annual reports to be expanding inexorably. In practice, the picture is more nuanced.

Across the UK, Europe and the US, companies are not simply adding or removing content. Instead, they are restructuring, relocating and experimenting with how sustainability information is presented, driven by regulation, political context, investor expectations and practical constraints.

This paper draws together recent market analysis, company examples and regulatory developments to explain what is changing, and why.

FTSE 100 reporting trends: no simple story on length

For FTSE reporters, the Strategic Report remains the primary location for sustainability disclosures.

• In 2024, the average FTSE 100 Strategic Report was 86 pages, reducing slightly to 82 pages in 2025.

• Pages dedicated to sustainability averaged 29 pages in 2024 and 28 pages in 2025.

• Of the companies analysed, 39 increased sustainability content within the Strategic Report, while 41 reduced it.

See Fig.1, and associated analyses, conducted by Bridgewell Corporate Communications2,3

This lack of a clear directional trend suggests that FTSE companies are responding very differently to the same pressures. Those already struggling with scale are actively trying to manage it; others continue to add content where they feel exposed, uncertain or underprepared.

2 83 FTSE 100 companies were analysed, being those that had produced a report at the time of the review.

3 Bridgewell Corporate Communications (2025) How is the Elephant Doing?

Figure 1: ESG pages in a Strategic Report

Sustainability pages in 83 FTSE100 companies analysed. Sustainability includes “sustainability; stakeholders; s172(1) statement; Non-financial and sustainability information statement; TCFD; TNFD etc).

x 2024

+ 2025

Managing scale without abandoning disclosure

Where reductions have occurred, they are rarely the result of cutting sustainability ambition. Instead, companies are relocating information to improve structure and readability.

Unilever, RELX and IAG have reduced their Strategic Report length by around 20–30%, largely by moving sustainability disclosures into “Additional Information” sections. Shell, Barclays, Standard Chartered, HSBC and Intertek have taken similar approaches, with Shell and Unilever explicitly linking this restructuring to early adoption of EU CSRD requirements4.

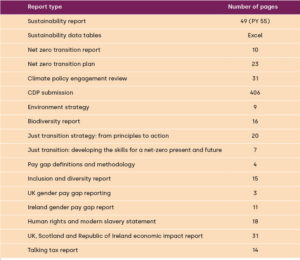

UK utilities such as SSE provide a clear illustration of this shift. Rather than forcing all sustainability-related information into a single document, SSE publishes a Strategic Report supported by a broader reporting ecosystem covering climate transition, biodiversity, workforce, data tables and policy positions (Table 1). While the overall volume of sustainability disclosure is substantial the sustainability content in its Strategic Report reduced from 43 pages to 32 pages in its most recent annual report.

The scale of SSE’s reporting makes one thing clear: it is no longer realistic to expect all sustainability information to sit coherently in one document.

4 Bridgewell Corporate Communications (2025) How is the Elephant Doing?

Table 1: SSE’s corporate annual reporting and associated documents

Why responses to reporting may differ

In simple terms, companies have two fundamental legal obligations:

• To create value for shareholders5

• To report on what could materially affect that value

Where sustainability reporting is treated as a separate system rather than integrated into these obligations, duplication and fragmentation are almost inevitable.

Recent developments in the US illustrate this tension in its most extreme form. Anti-ESG rhetoric has framed sustainability as being in conflict with shareholder value. For example, arguing that capital allocated to net-zero initiatives reduces funds available for near-term returns to shareholders. Combined with heightened greenwashing and litigation risk, this has contributed to a watering down of sustainability disclosures and withdrawal from voluntary initiatives such as the Net-Zero Banking Alliance.

In CBG’s view, this does not signal an abandonment of sustainability objectives, but rather a response to political and legal risk. The consequence, however, has been reduced comparability and weaker collective accountability at a global level.

These concerns are not unique to the US. Even before recent political shifts, asset managers and corporates raised concerns about inconsistent reporting standards across jurisdictions, alongside the cost and complexity of compliance. Similar feedback has been reflected in EFRAG consultations and informed efforts to reduce reporting burden through the EU Omnibus process.

Market evidence reinforces this reassessment. Analysis by Orrick shows a decline in the number of S&P 500 companies publishing standalone sustainability reports in the first half of 2025 compared with the same period in 20246. Trellis reports that political scrutiny and litigation risk are driving more cautious language, tighter framing and, in some cases, withdrawal from voluntary disclosure formats7.

Taken together, this does not point to a retreat from sustainability, but to a reassessment of how it is reported.

5 Under section 172 of the UK’s Companies Act (2006), directors must promote the success of the company for the benefit of its members, while having regard to: employees, suppliers, customers, community and the environment, reputation, and the likelihood of any decision in the long-term. Fairness between members is also required.

6 Orrick (2025) How Major Corporations Are Changing Their Sustainability Reporting Practices

7 Trellis (2025) How the anti-ESG movement is reshaping corporate sustainability reports

Why this is not about “less sustainability”

At CBG, we view sustainability fundamentally as a question of long-term value creation and value protection. Yet it has often been framed in the language of “doing good”, obscuring the underlying commercial rationale and positioning organisations as acting primarily out of altruism rather than enlightened self-interest on behalf of shareholders.

In practice, sustainability action is usually driven by clear economic incentives:

• Retailers address human-rights risks because brand value and licence to operate are at stake.

• Construction companies invest in sustainability because access to public-sector contracts increasingly depends on it.

• Financial institutions assess climate risk because it affects asset values, capital requirements and cost of capital.

The challenge for sustainability teams is not motivation to drive meaningful change but expressing these drives in a way that aligns with financial decision making. At the same time, CFO’s are operating in an environment of heightened geopolitical risk, regulatory pressure and economic uncertainty, requiring sharper judgement about where effort and capital are deployed.

Connecting sustainability, finance and risk is therefore essential. Not only for organisational resilience, but also to prepare for evolving reporting requirements that increasingly emphasise connectivity between financial and sustainability reporting.

What IFRS S1 and S2 change, and what they don’t

IFRS S1 and S2 are often misunderstood as simply “more ESG reporting”. Their real significance lies in connectivity. They focus on sustainability-related risks and opportunities that could reasonably be expected to affect:

• cash flows

• access to finance

• cost of capital

IFRS-based sustainability reporting has the potential to improve discipline and focus, by placing responsibility with a central team that has the governance, financial literacy and authority to strip out immaterial narrative and anchor disclosures to core strategy and value creation.

However, this shift is not without risk. Many sustainability-related risks are inherently opaque, highly uncertain or difficult to quantify, and may sit outside traditional financial time horizons. Without the right tools, judgement frameworks and forward-looking analysis, there is a danger that genuinely material issues are excluded simply because they do not yet translate cleanly into numbers.

The challenge is therefore not whether sustainability reporting should sit alongside financial reporting, but how organisations ensure that material risks, dependencies and opportunities are identified early and explained clearly, even where precision is imperfect.

The UK sustainability reporting environment

The UK Government is expected to bring in IFRS S1 and S2 as the UK Sustainability Reporting Standards in February8, initially as a voluntary reporting standard. The FCA is expected to consult on the standards and make them mandatory reporting requirements under the listing rules. The information disclosed via UK SRS will likely be assured under the International Standard on Sustainability Assurance (UK) 5000, the UK adaptation of the global benchmark developed by the International Auditing and Assurance Standards Board (IAASB). The level of assurance required on UK SRS disclosures will be determined but will likely to be voluntary to begin with9.

8 Ravi Abeywardama (Director of Sustainability, Reporting and Assurance at ICAEW) LinkedIn post

9 ICAEW (2026) Prepare for 2026: Sustainability reporting and assurance

The CBG perspective: clarity over volume

The imminent arrival of IFRS-based sustainability reporting renews pressure to move sustainability reporting closer to the core disciplines of financial reporting and risk management. This creates an opportunity to reduce duplication and improve focus, but only if organisations integrate sustainability into existing governance, strategy and risk processes rather than layering new narratives on top.

Doing this well requires a clear shift in emphasis. Sustainability needs to be:

• Anchored within the core strategy with a clear business case

• Explicitly linked to value creation and value protection

• Articulated in terms of risks and opportunities for shareholders without generic narrative

• Connected to the numbers, assumptions and judgements in the financial accounts

The key question that reporters should return to is:

“What future are we planning for, and what information is genuinely needed to explain our strategy, risk and performance in that context?”

This approach does not guarantee shorter reports. It provides a framework for better judgement, stripping out immaterial narrative while ensuring that genuinely material, though uncertain, risks are identified early and explained clearly.

CBG Expertise: bridging finance and sustainability

Connecting sustainability and finance is precisely where CBG’s expertise sits. Drawing on deep experience from the A4S Net Zero Taskforce and extensive work with CFOs, we help organisations move from abstract sustainability risks to decision-useful insights: linking transition and physical risks to cash flows, asset values, cost of capital and competitiveness. By reframing sustainability through the lens of financial impact and strategic resilience, we enable finance and sustainability teams to exercise informed judgement, retaining what truly matters, discarding what does not, and building a sustainability narrative that supports both credible reporting and long-term value creation.

CBG recommendations

The principles set out above have practical implications for how organisations structure sustainability reporting. In practice, teams need a way to decide what belongs in the Annual Report, what should sit elsewhere, and how sustainability can be integrated into existing governance, strategy and risk processes without creating duplication. The table below sets out a practical framework to support those decisions.

Table 2: A practical framework to support external reporting

About the author

Helen Wain, ACA, CTA is a chartered accountant who leads investor-related reporting at CBG, helping clients integrate climate-related risk, transition planning and net zero strategy into financial decision making and investor disclosures, bridging the gap between sustainability and finance. She previously worked with Deloitte and BDO. She acted as technical lead and author for the A4S Net Zero Taskforce on Aligning Financial Planning and Transition Planning. She also developed and delivered elements of the A4S Academy which focuses on supporting finance teams embed sustainability into their practice.

Helen is also Director of IMS Transition and Finance supporting organisations move from abstract sustainability risks to decision-useful insights, linking transition and physical risks to cash flows, asset values, cost of capital and long-term competitiveness operating across three continents and focussing on:

• Double materiality assessments

• Impact, Risk and Opportunity (IRO) analysis

• Scenario analysis

• Net zero and sustainability strategy

• Sustainability and carbon reporting and disclosure

• CDP support and ScoreCHECK

IMS Transition and Finance Ltd is a partner to CBG